Crypto Daybook Americas: Bitcoin Bargain Hunting Faces Crucial Jobs Report Test

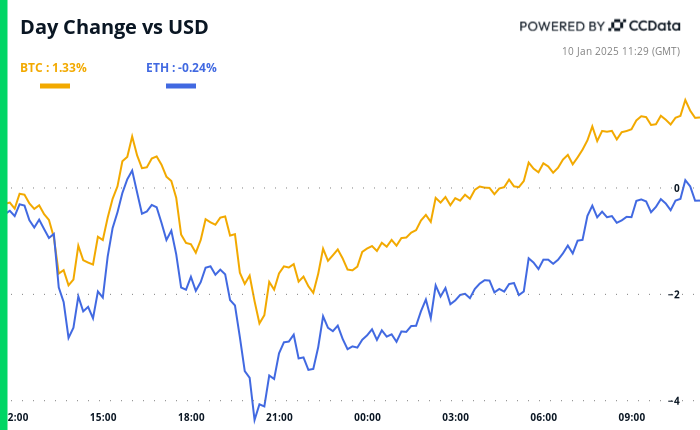

By Omkar Godbole (All times ET unless indicated otherwise) The crypto market has regained some stability, with BTC rising back to nearly $95K as order books signaled the presence of bargain hunters. Late Wednesday, prices tested the long-standing support zone of $90K-$93K, which has successfully halted downward movements at least six times since the second […]

Crypto Daybook Americas: Bitcoin Bargain Hunting Faces Crucial Jobs Report Test Read More »