Size Matters

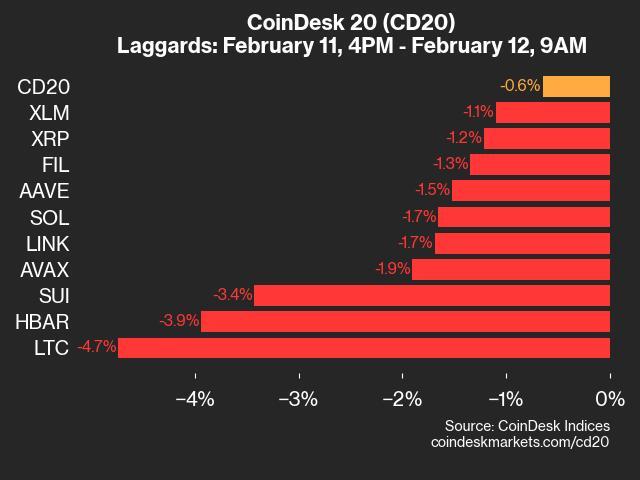

Crypto mid-caps are struggling. While some digital asset investors may seek hidden gems and future powerhouses in the next tier of market capitalization and liquidity, that pursuit has generally not been rewarded. Furthermore, mid-caps have delivered significantly higher volatility. Less reward, more risk. What gives? Is this a mirror of “Mag 7” dominance in equities, […]